Build Lasting Financial Security Through Smart Savings

Most Australians approach savings backwards. They save what's left after spending instead of prioritizing their financial future first. Our program teaches you the practical framework that shifts this mindset completely.

Winter 2026 intake opens May. Applications accepted from March onwards for our comprehensive six-month structured learning experience.

Three Core Pillars of Effective Savings Strategy

We don't teach generic budgeting tips you'll find in any blog post. Our approach combines behavioral finance principles with practical Australian market conditions to create strategies that actually stick.

Automatic Systems Design

Most people fail at saving because they rely on willpower. Instead, we build automated systems that work whether you're motivated or not.

- Split banking structures for different goals

- Payroll redirection strategies

- Emergency fund staging approaches

- Transaction-free savings accounts

Expense Category Analysis

You can't improve what you don't measure. We teach detailed tracking methods that reveal exactly where your money actually goes each month.

- Variable versus fixed expense identification

- Discretionary spending patterns

- Hidden subscription discovery methods

- Quarterly review frameworks

Goal-Based Allocation

Generic advice says save 20% of income. That's meaningless without context. We match savings rates to specific, time-bound personal objectives.

- Short-term goal funding strategies

- Medium-term investment bridges

- Long-term wealth accumulation paths

- Lifestyle inflation prevention tactics

How Different Approaches Actually Perform

People always ask about the difference between basic budgeting and structured savings frameworks. Here's what twelve months of consistent application typically shows based on participant outcomes from 2024-2025.

| Measure | Basic Budgeting | Structured Framework |

|---|---|---|

| Monthly consistency | 4-5 months active | 11-12 months active |

| Emergency fund completion | 38% reach target | 82% reach target |

| Tracking accuracy | ±15% variance | ±3% variance |

| Goal achievement rate | 2.1 of 5 goals | 4.3 of 5 goals |

| System sustainability | Requires constant effort | Functions automatically |

Our Teaching Methodology Explained

Financial education traditionally fails because it's either too theoretical or too simplistic. We've spent years refining an approach that balances conceptual understanding with immediate practical application. Students learn principles through real scenarios they'll face in their own financial lives.

What the Six-Month Journey Actually Involves

Months 1-2: Foundation Building

You'll map your complete financial picture, identify all income sources and expense categories, then establish your baseline savings capacity. No judgment about past habits. Just accurate data collection and honest assessment of current reality.

Months 3-4: System Implementation

This phase focuses on setting up automated structures. You'll open dedicated accounts, configure automatic transfers, establish spending guardrails, and begin tracking actual performance against projections. Adjustments happen weekly based on what's working.

Months 5-6: Optimization and Independence

By now your systems run automatically. We refine allocation percentages, address obstacle patterns that emerged, prepare you for predictable financial disruptions, and ensure you can maintain progress independently after program completion.

Real Experience From Recent Participants

We asked graduates from our 2025 cohort to share honest feedback about what worked, what challenged them, and whether the time investment proved worthwhile for their situation.

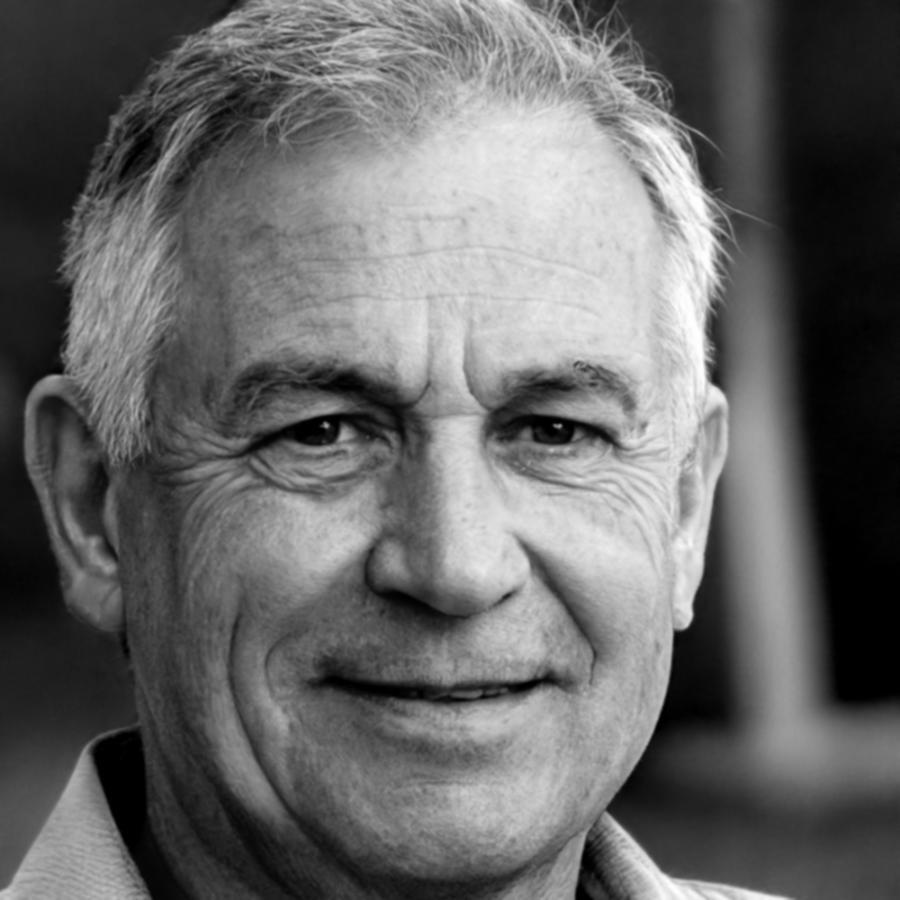

Callum Brennan

Completed Winter 2025 ProgramI'd tried budgeting apps and spreadsheets before, always quit within weeks. What made this different was building systems I didn't have to think about daily. Three months in, savings happened automatically while I focused on work and life. That shift from active effort to passive system changed everything for me.

- Program Duration: Six months, completed August 2025

- Primary Goal: Emergency fund and house deposit

- Background: Marketing professional, Sydney

- Key Outcome: Consistent monthly savings for 9 months running